Hey Doc, why are you talking about credit monitoring services? Two reasons, first it’s cold and rainy outside and I can’t shoot the video I had planned. Second because my favorite credit monitoring service just updated and the credit scores were great. So let’s talk about it. VIDEO BELOW ↓

Personal Notes:

- Yes, I have tried the other services… and I was furious to learn that many NEVER truly access or monitor your credit bureaus in REAL TIME. This service deals DIRECTLY with all three of your real credit reports.

- Personally I have used this credit monitoring service for over three years.

- REAL TIME information and monitoring is the KEY.

- There are only TWO THINGS THAT MATTER… I’ll discuss them.

When you click the link above you’ll be taken to the FULL service I use, it’s $29 per month and WELL worth it.

What you get…

- Custom Dashboard you can access at any time.

- All three credit bureau scores.

- Free report updates every quarter.

- Instant notifications of changes of you reports.

- Vary scores that different LOAN TYPES use. (Auto vs. Mortgage, etc)

- “Dark Web Scanning”

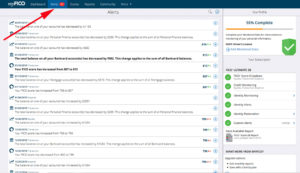

A look inside my credit monitoring dashboard

↓ Main Dashboard – Click to Expand

↓ Credit Alerts

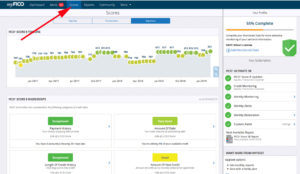

↓ Credit Scores all 3 bureaus

↓ Credit Reports

Here’s the TRUTH about most credit monitoring services. They DO NOT have instant access to your credit files and reports in real time. They rely on CREDIT PULLS that you authorize and they look for information that has changed. The → MYFICO program I use has instant access to real time information and alerts you instantly.

The ABSOLUTE KEY NOTIFICATION you should be watching for are NEW CREDIT INQUIRIES.

You need to ASSUME that your information is out there in the “dark web”. Trust me, it is. But that’s not the critical point to credit monitoring. The question is… do they have ALL your information and are they taking ACTION with that information.

If you do get a fraudulent inquiry or activity, simply place a credit fraud alert on your report. You only have to do this with ONE agency as they are required to report this to the other two. You can also eventually place a LONG TERM report that last years, but you need to file a police report or gov report.